16 Best Mortgage Loan Origination Software Companies To Integrate With in 2026

Mortgage lenders and brokers face growing pressure to streamline operations, improve compliance, and enhance borrower experiences. Choosing the right mortgage loan origination software (LOS) can make a big difference in achieving these goals.

In this guide, we explore what mortgage LOS systems are, the key benefits they offer, and 16 of the best mortgage LOS companies you can integrate with in 2026.

What is mortgage loan origination software?

Mortgage loan origination software is a digital platform that automates and manages the loan lifecycle from application to closing. Modern LOS systems handle tasks such as:

- Loan application intake and processing

- Document collection and verification

- Underwriting and credit decisioning

- Compliance with federal and state lending regulations

- Closing and funding management

- Reporting and analytics

By moving these tasks to a centralized platform, lenders can reduce manual errors, improve processing speed, and deliver a better experience to borrowers.

How to Properly Vet a Loan Origination System (LOS)

Choosing the right loan origination system is a critical step for any lender, whether you’re a small brokerage or a large, multi-channel institution. Before you commit to a vendor, make sure you thoroughly evaluate these essential factors:

1. Map Your Use Cases

Start by identifying the types of loans you originate today—and those you plan to offer in the future. Consider whether your lending mix includes residential mortgages, HELOCs, personal loans, non-QM products, or private money loans. Your LOS should be able to support both your current needs and future growth, including requirements like investor delivery, secondary-market workflows, or loan servicing.

2. Check Compliance & Regulatory Support

Compliance is non-negotiable. A strong LOS should help you meet federal, state, and investor-specific regulations with automated disclosures, audit trails, TRID-compliant workflows, and quality-control tools. This is especially important if you originate conforming or government-backed loans, where compliance errors can lead to costly delays or repurchase risks.

3. Assess Integration Requirements

Modern loan origination depends on seamless connectivity. Look for a system that integrates with the tools you rely on—credit bureaus, appraisal and title vendors, e-signature providers, income and asset verification services, PPE/pricing engines, and, if relevant, servicing platforms. A well-connected LOS reduces manual work, improves data accuracy, and boosts processing speed.

4. Evaluate Implementation Time & Internal Resources

Not all LOS platforms require the same level of setup. Enterprise-grade systems often involve significant configuration, staff training, and change-management planning. Cloud-native or lightweight LOS platforms can usually be deployed faster with fewer internal resources. Make sure the implementation timeline aligns with your operational capacity and business goals.

5. Prioritize Borrower Experience

The borrower experience is a key differentiator. Look for features like digital loan applications, mobile-friendly portals, e-sign capabilities, document-upload tools, and real-time status updates. A frictionless user experience leads to higher conversion rates and satisfied borrowers.

6. Consider Scalability & Flexibility

Your LOS should grow with you. Ensure the system can scale as your volume increases or as you introduce new loan products. Highly customizable workflows, rule-based automation, and modular features can help you adapt without needing to switch platforms down the road.

Top Mortgage LOS Companies to Integrate With

Here’s a curated list (in no particular ranking order) of 16 LOS systems popular among lenders for 2026, along with key features and ideal use cases.

1. MeridianLink Mortgage

MeridianLink Mortgage is a cloud-based LOS known for workflow automation, compliance management, and its highly configurable process engine. The platform focuses on data integrity and efficiency, helping lenders reduce manual steps while maintaining strict control over compliance and pricing.

Key Features:

– Configurable workflow automation and task routing – SmartAudit™ compliance and data checks

– Product and pricing engine (PPE) integration

– Borrower portal with digital applications and eDocs

– API ecosystem for credit, verification, and vendor services

Pros:

– Strong compliance tools and audit automation – Highly configurable workflows and pricing rules

Cons:

– Implementation may require dedicated internal resources – UI can feel more functional than modern

Ideal for:

– Mid-size lenders needing strong compliance automation and efficient workflows

2. Byte

Byte is an enterprise-class LOS designed for lenders, credit unions, and brokers that need strong customization and lifecycle automation. The platform supports everything from application through disclosures, underwriting, and closing while allowing teams to tailor workflows to their exact processes. Its macro-based automation engine is one of its biggest differentiators.

Key Features:

– Customizable workflows and macro-based automation – Document management and borrower portal

– Compliance auditing, fee generation, and disclosure tools

– Flexible deployment options (cloud-hosted or on-premises)

Pros:

– Highly customizable automation and workflows – Strong compliance and audit tracking

Cons:

– Requires internal resources to configure advanced rules – More setup time compared to “plug-and-play” LOS systems

Ideal for:

– Mid-size to large mortgage lenders and credit unions that want full control over their workflows

3. Calyx Point

Calyx Point is a long-standing LOS built for mortgage brokers and small lenders who need an affordable, reliable solution for residential lending. It offers both desktop (Point) and cloud-hosted (PointCentral) deployments, making it a flexible choice for different office setups. With integrated tools like Calyx Zip and extensive third-party connectivity, it covers the essentials of mortgage origination at a competitive price.

Key Features:

– Desktop and cloud deployment options – Calyx Zip online borrower application

– Automated disclosures and compliance form updates

– 200+ integrations with credit, appraisal, and title vendors

– Workflow configuration for branches and user roles

Pros:

– Cost-effective and proven reliability – Strong compliance coverage and vendor integrations

Cons:

– Outdated UI and slower innovation cycle – Limited support for non-mortgage lending products

Ideal for:

– Independent brokers and small lenders needing an affordable, mortgage-specific LOS

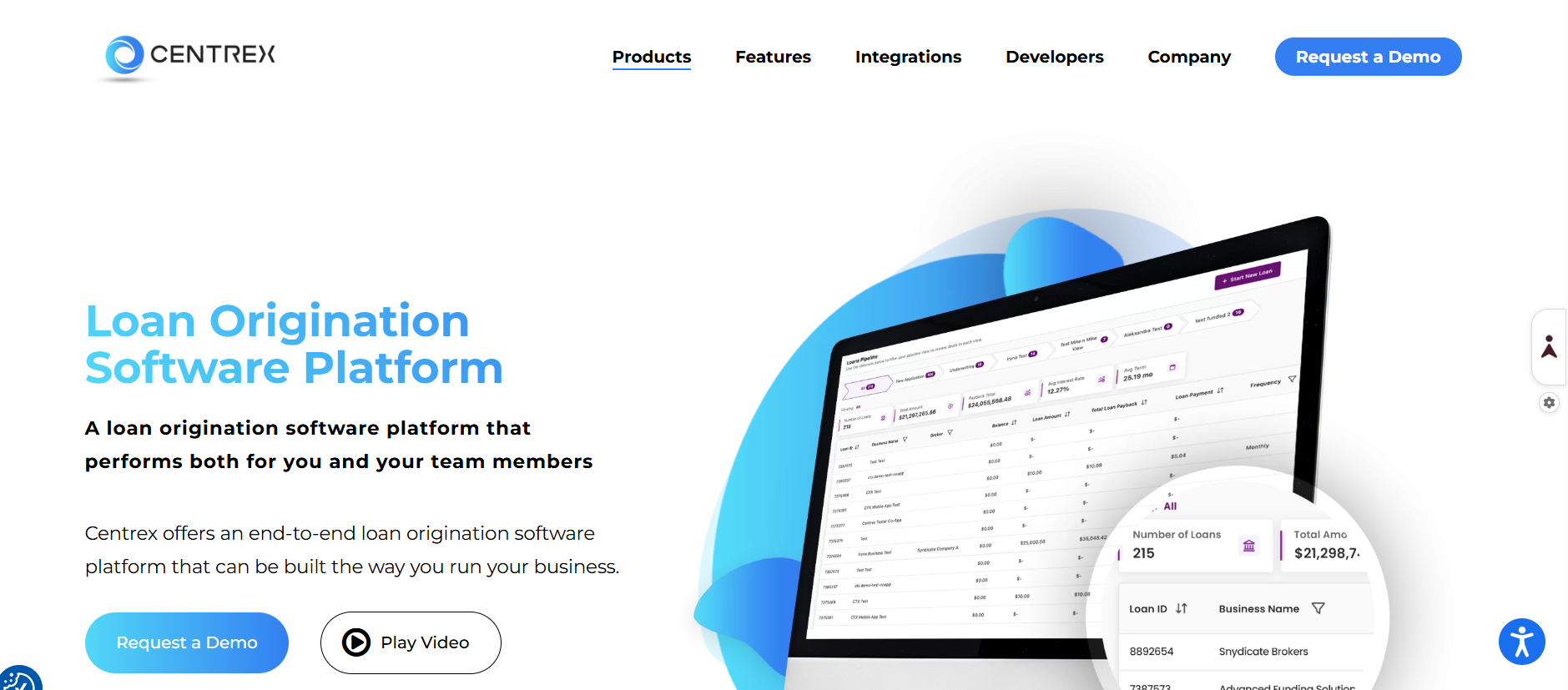

4. Centrex

Centrex Software is a cloud-based LOS and CRM solution designed for mortgage lenders, brokers, and financial services companies that require both lead management and loan workflow automation. The platform brings origination, CRM, email marketing, and document management into a single system, making it appealing for organizations that want an all-in-one tech stack without relying on multiple vendors.

Key Features:

– Integrated CRM for lead tracking and marketing campaigns – Customizable workflows and pipeline automation

– Borrower and lender portals with secure document uploads

– Task management, role permissions, and automated notifications

– Marketplace of API integrations for credit pulls, pricing, and verification services

Pros:

– Combines LOS, CRM, and workflow automation in one system – Highly configurable workflows and user roles

Cons:

– Broad feature set may feel overwhelming for smaller teams – Some integrations require setup assistance or additional fees

Ideal for:

– Lenders wanting a single platform for CRM, workflow automation, and loan management

5. C2 Covalent

C2 Covalent is a modern, configurable LOS focused on consumer, auto, and personal lending as well as mortgage workflows for institutions needing strong rules-based automation. It combines underwriting, workflow routing, and document management with real-time decisioning and customizable lending logic. The platform is built for institutions that manage multiple loan products and want to standardize processes under one system.

Key Features:

– Rules-based underwriting and decisioning – Drag-and-drop workflow builder

– Borrower portal with digital applications

– Document imaging, eSign, and automated disclosures

– API connectivity to credit bureaus, verification services, and core systems

Pros:

– Strong decisioning and workflow automation – Supports multiple lending products under one platform

Cons:

– Implementation can be complex for heavily customized setups – Less widely adopted than major mortgage-only LOS systems

Ideal for:

– Lenders offering multiple loan types who need configurable workflows and decisioning

6. Encompass by ICE Mortgage Technology

Encompass is one of the industry's leading enterprise LOS platforms, supporting the entire mortgage lifecycle from application to closing and investor delivery. It integrates deeply with ICE’s ecosystem, including pricing engines, eClose tools, and a vast partner network. Its strong compliance engine and scalability make it a core system for mid- to large-size lenders.

Key Features:

– End-to-end loan management and automation – 500+ ICE Marketplace integrations

– Built-in product and pricing engine (ICE PPE)

– Full eClose with eNote and MERS eRegistry

– Robust compliance tools for TRID, HMDA, RESPA

– Borrower portal with secure document upload

Pros:

– Industry-leading compliance and integrations – Highly scalable for growing lenders

Cons:

– High cost and long implementation time – User interface can feel outdated

Ideal for:

– Mid- to large lenders needing a unified, compliance-driven LOS

7. Floify

Floify is a mortgage point solution focused on borrower communication and document management rather than full LOS functionality. It integrates directly with major LOS systems—including Encompass, Calyx, and LendingPad—making it a powerful companion tool for lenders wanting to improve borrower experience and reduce manual follow-up.

Key Features:

– Borrower portal for document upload and status tracking – Automated SMS/email reminders

– Pre-approval letter generation

– Mobile-friendly interface

– LOS integrations for seamless data sync

Pros:

– Excellent borrower experience and document tracking – Easy to implement and integrates with major LOS platforms

Cons:

– Not a full LOS – Pricing can increase with higher loan volumes

Ideal for:

– Lenders wanting smoother borrower communication and automated document collection

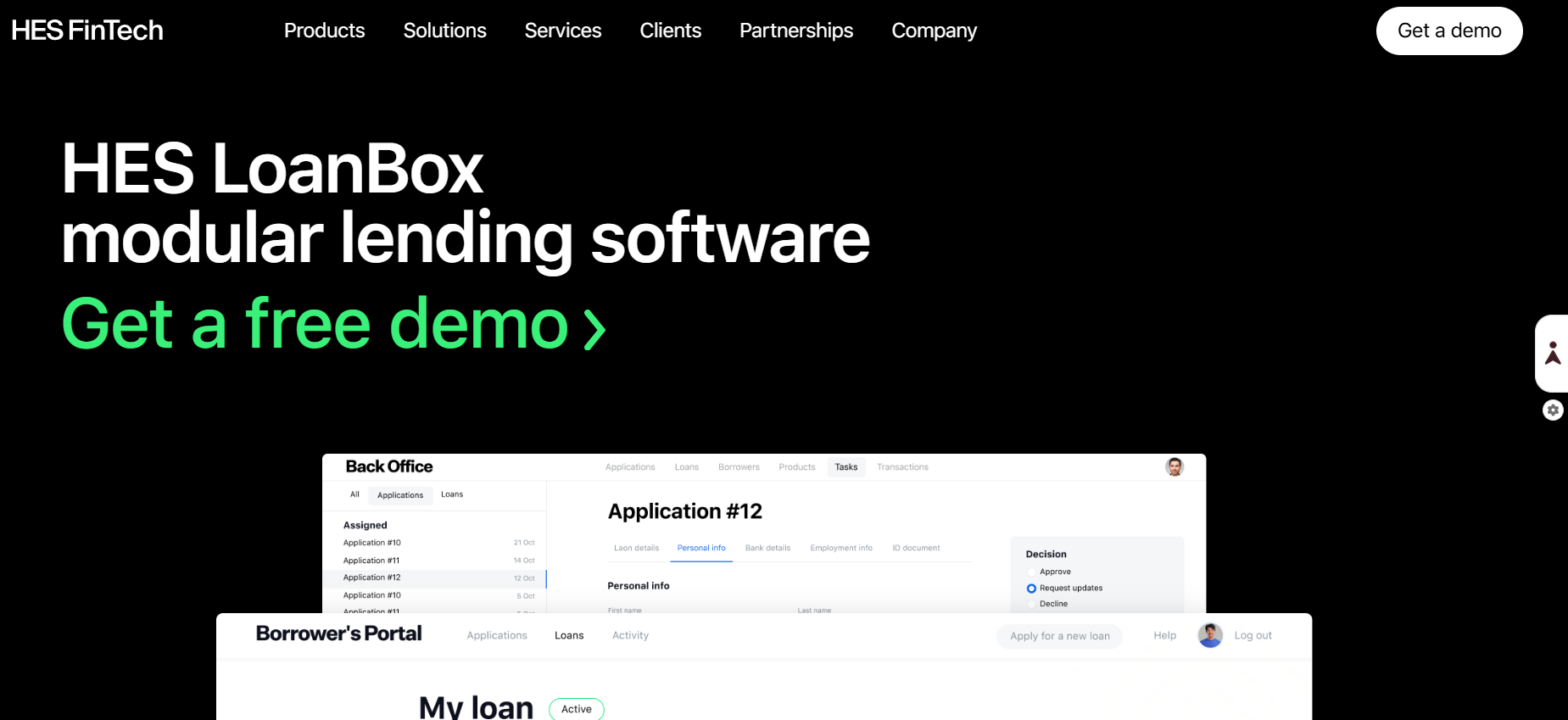

8. HES LoanBox

HES LoanBox is a modern, AI-powered LOS designed for lenders that need a fully customizable, end-to-end lending platform. It offers advanced credit decisioning, a modular architecture, and the ability to tailor every component—from workflows to scoring logic—making it highly adaptable for consumer, commercial, or alternative lending models.

Key Features:

– AI-powered credit scoring and real-time decisioning – End-to-end loan origination and servicing

– Configurable product engine for any loan type

– Debt collection automation with predictive analytics

– Multi-entity and multi-currency support

– 100+ prebuilt API integrations

Pros:

– Fully customizable with enterprise-level flexibility – Supports the entire lending lifecycle in one platform

Cons:

– Feature-rich system may require more implementation time – Best suited for teams with defined processes

Ideal for:

– Lenders needing a customizable, all-in-one LOS with advanced AI decisioning

9. LendingPad

LendingPad is a cloud-native LOS designed for mortgage lenders, brokers, and financial institutions needing a modern interface, real-time collaboration, and cost-effective pricing. Multiple team members can work on the same loan file simultaneously, improving speed and transparency throughout the origination cycle.

Key Features:

– Real-time multi-user collaboration – Integrated CRM for lead management

– Automated compliance reviews (QM, TRID)

– E-sign, document management, and secure cloud storage

– Integrations with credit, appraisal, and title vendors

Pros:

– Modern and intuitive interface – Affordable with strong collaboration tools

Cons:

– Some disclosures require manual processes – Advanced automation features are still evolving

Ideal for:

– Mortgage teams wanting a modern, cloud-based LOS with strong collaboration

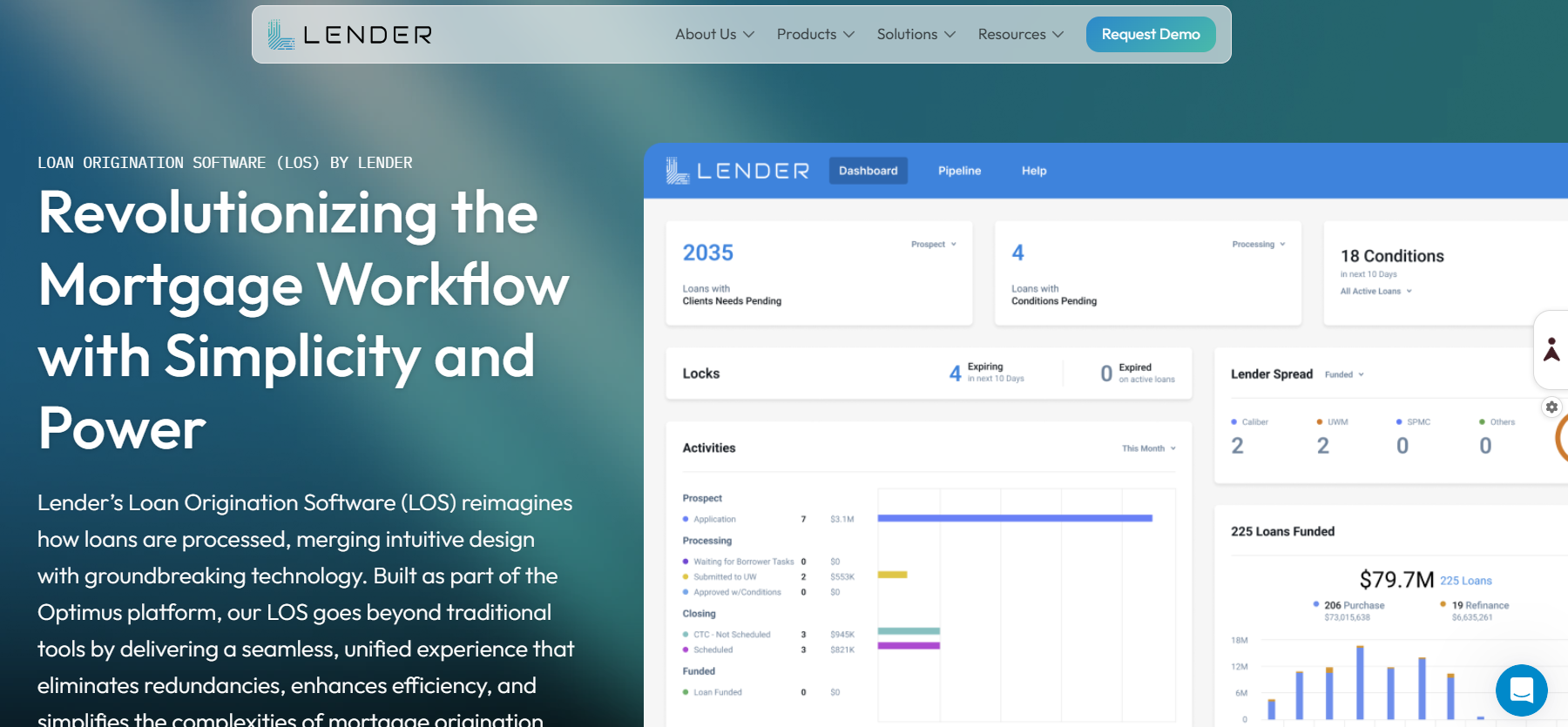

10. Lender

Lender is built specifically for private and hard money lenders who fund real estate projects such as fix-and-flip, bridge, and rental loans. It combines origination, servicing, and investor management in one system, allowing lenders to track capital, manage borrowers, and provide investors with real-time insights into portfolio performance.

Key Features:

– Pipeline dashboard with drag-and-drop loan stages – Borrower and investor portals

– Document generation and automated payoff statements

– ACH payment processing and reporting

– AI-enhanced workflow automation

Pros:

– Purpose-built for private/hard money lending – Strong investor and capital management tools

Cons:

– Not suitable for conventional mortgage lending – Limited features for consumer loan products

Ideal for:

– Private lenders and real estate investors needing combined origination + servicing

11. Mortgage Automator

Mortgage Automator is a LOS and servicing platform tailored to private lenders and alternative finance companies. It automates origination, servicing, investor reporting, and document creation, making it especially valuable for lenders managing multiple investors or complex real estate deals.

Key Features:

– Automated document generation and eSign – Servicing tools for payments, escrows, and investor distributions

– Borrower and investor portals

– Real-time reporting for lenders and investors

– Workflow automation for underwriting and approvals

Pros:

– Strong servicing and investor management features – Highly automated document workflows

Cons:

– Best suited for private lending, not standard mortgages – Customization may require setup support

Ideal for:

– Private/hard money lenders needing origination + servicing + investor reporting

12. Finastra Originate Mortgagebot

Mortgagebot, part of Finastra’s Originate suite, is an enterprise-level mortgage platform for banks and credit unions. It offers omnichannel digital applications, automated disclosures, underwriting workflows, and deep core banking integrations, making it particularly strong in regulated financial environments.

Key Features:

– POS + LOS integration for retail, wholesale, and correspondent channels – Automated disclosures and rules-based decisioning

– Core banking integration with Finastra systems

– Borrower-facing digital application tools

– Analytics and benchmarking against 1,000+ institutions

Pros:

– Strong compliance and bank-grade security – Seamless integration with core systems

Cons:

– Long implementation timelines – Less flexible for nontraditional lending

Ideal for:

– Banks and credit unions needing enterprise-grade compliance and system integration

13. TaskSuite

TaskSuite is a modular LOS and workflow automation platform designed for lenders who want extensive customization and control over task routing. It focuses on process automation, document workflows, and team management, giving lenders the ability to build bespoke origination flows without relying on rigid templates.

Key Features:

– Custom workflow and pipeline management – Role-based task automation

– Document tracking, eSign, and audit trails

– Integrations for credit, verification, and data checks

– Reporting dashboards for loan performance and activity

Pros:

– Highly customizable task and workflow automation – Modular design allows for tailored implementations

Cons:

– Smaller ecosystem compared to major LOS vendors – Requires configuration to unlock full automation capabilities

Ideal for:

– Lenders needing build-your-own workflow automation within a flexible LOS

14. The Mortgage Office

The Mortgage Office (TMO) is a mature loan management platform focused on private lenders, hard-money lenders, municipalities, and other non-bank lenders. It combines loan origination, servicing, and fund/investor management in one system and emphasizes accuracy, automation, and configurable workflows to handle complex funding and servicing scenarios.

Key Features:

– Loan origination module with borrower profiles and rules-based workflow automation – End-to-end servicing: payment processing, escrow tracking, automated statements, and investor distributions

– Fund management and investor portals for waterfalls, distributions, and capital tracking

– Reporting, customizable dashboards, and integrations with title/appraisal/accounting vendors

Pros:

– Strong servicing and fund-management capabilities built for investor-backed lending. – Proven in private-lending markets with long track record and many customers.

Cons:

– Not optimized for conventional retail mortgage bank workflows (e.g., investor delivery pipelines common to conforming mortgages). – May require configuration to support mortgage-specific regulatory disclosure needs if used for standard retail origination

Ideal for:

– Private lenders, hard-money shops, funds/REITs, and municipal or specialty lenders that need integrated origination, servicing, and investor/fund management

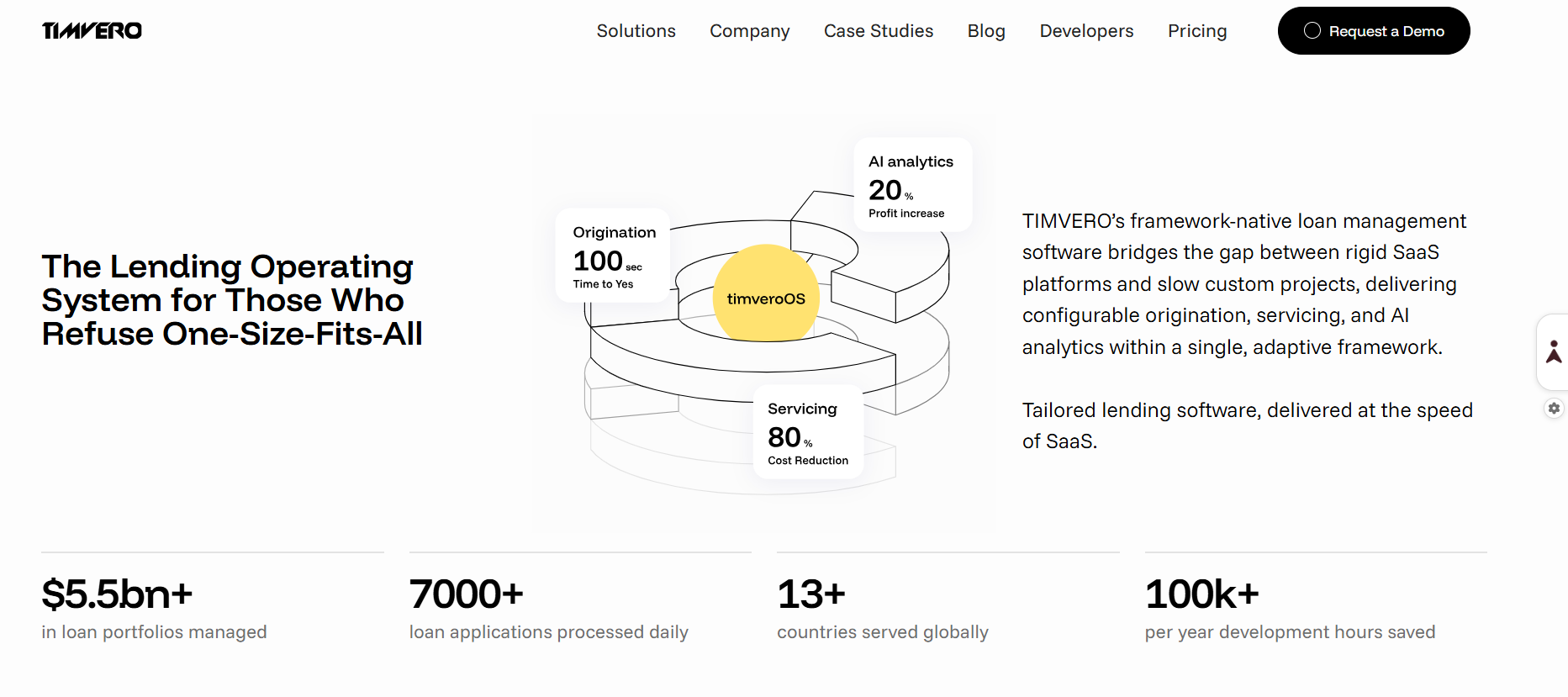

15. TIMVERO

TIMVERO is a modular loan origination and management platform aimed at banks, credit unions, and fintech lenders that need configurable underwriting, workflow/BPM, and analytics. It’s pitched as a flexible alternative to monolithic LOS suites, letting lenders pick modules (origination, underwriting, servicing, analytics) that match their product mix.

Key Features:

– Modular architecture (origination, BPM/workflow, underwriting, analytics) – Customizable underwriting engine and rules-based decisioning

– Business Process Management (BPM) for configurable workflows

– Reporting and ML-backed analytics for risk and profitability insights

– API connectivity for credit, verification, and third-party services

Pros:

– Highly flexible and modular — pay for only the components you need – Strong analytics/decisioning capabilities for varied loan products

Cons:

– Smaller public footprint than legacy LOS — requires vendor vetting – May need implementation support for complex mortgage compliance mapping

Ideal for:

– Fintechs, community banks, and credit unions that want a modular LOS with strong analytics and configurable underwriting

16. TurnKey Lender

TurnKey Lender is an end-to-end lending automation platform that combines origination, AI-driven decisioning, servicing, and collections. It’s designed to support multiple loan products (consumer, commercial, SME, and mortgages) and is notable for its emphasis on automated credit decisioning and rapid product launches.

Key Features:

– AI-powered decision engine and automated underwriting – Configurable loan application flows and borrower portals

– End-to-end servicing and collections automation

– Business rules engine and product configuration for quick launches

– APIs for credit bureaus, payment processors, and verification services

Pros:

– Powerful AI/decisioning reduces manual underwriting workload – Broad end-to-end feature set covering origination through collections

Cons:

– Implementation complexity for highly customized mortgage programs – May be more than needed for lenders focused only on traditional residential mortgages

Ideal for:

– Non-bank lenders, fintechs, and portfolio lenders seeking strong automation and data-driven underwriting across diverse loan products

How Soft Pull Solutions Can Help

Integrating the right mortgage LOS is only part of the process. Soft Pull Solutions enhances your lending operations by providing real-time bank verification, income validation, and automated background checks. This ensures that loan origination is not only faster but also more accurate, improving approval confidence and reducing the risk of defaults.

By connecting Soft Pull Solutions with your chosen LOS, you gain a seamless, end-to-end workflow from application to funding—allowing your team to focus on growing your business rather than manual verification tasks.